ForFarmers has disappointing first quarter, expects profits to slide

Its FY2018 results, published in March, showed a decline and that trend has not been reversed.

CEO, Yoram Knoop, expects the Dutch group’s underlying EBITDA in the first half-year 2019 to drop by between 30% and 35%, compared to the first half of 2018, and also the underlying EBIT and underlying net profit to slide between 55% and 60%.

“The development of underlying EBITDA in the first quarter of 2019 is disappointing, although in line with expectation for the first half-year as announced last March. The positive contribution of the acquisitions could not compensate the like-for-like decline in the results. Like-for-like, less compound feed was sold in all species and in all countries except Germany.”

He said the volume decline was particularly due to the reduction in cattle and pig herd sizes in the Netherlands at the end of last year, given the fact that country has the largest contribution to the company’s results.

There were some positives though.

“In general, in challenging market circumstances in the countries in which we are active, we managed to gain customers compared to the fourth quarter of 2018. The temporary unfavorable purchasing positions, however, led to a strong decline of underlying EBITDA. The purchasing risk procedure is currently being further assessed to determine how to better bear the impact of intense volatility of raw material prices on results in the future.”

The CEO estimates that the underlying EBITDA for FY2019 will be lower than that in 2018.

Market dynamics

Citing the acquisition of Tasomix in Poland in July last year and like-for-like growth in Germany in all species, ForFarmers reported higher sales of Total Feed in those two markets.

The German market saw a hike in volumes sold to pig and layer farmers in particular.

“In Poland, the volatility in prices for broilers in the past quarter led to the situation that, when prices were low, poultry farmers refilled their stables with chickens at a slower pace. This was temporary noticeable in volume developments. Towards the end of the first quarter prices for broilers recovered.”

In the UK market, the company said Total Feed volume declined, with less feed sold in the ruminant sector, and volumes in the swine sector also decreased, but volume growth in the poultry sector continued, particularly in relation to broiler production.

Netherlands and Belgium

In the Netherlands and Belgium, ForFarmers said its Total Feed volume remained stable due to a positive acquisition impact but that was offset by a like-for-like volume decline. Total Feed volume decreased in the ruminant sector, given that the Dutch dairy herd decreased substantially towards the end of 2018 following measures to reduce phosphate emissions.

“The number of beef cattle in Belgium declined because of low customer profitability. In the swine sector, Total Feed volumes increased mainly due to the acquisition of Voeders Algoet in Belgium.

"Less Total Feed was sold to pig farmers in the Netherlands because of declining herd sizes. Total Feed volume declined in the poultry sector, especially among layer farmers, as a number of pre-sales contracts were discontinued at the end of 2018.

"In addition, the decision in Belgium to discontinue a number of loss-making contracts with broiler farmers also put pressure on the volume development.”

Cost saving measures

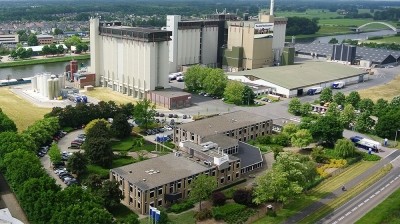

The company said it has made a start on its previously announced efficiency plans, which are aimed at making a cost saving of €10m by 2021 compared to 2018, to improve the underlying EBITDA/gross profit ratio.

That rationalization process is said to involve feed mill closures and a reduction in headcount.