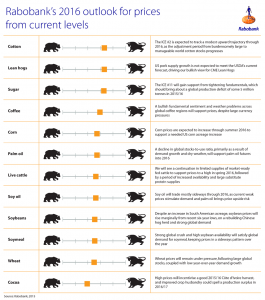

No change to soymeal story for 2016, says Rabobank in its agri commodity outlook

The Dutch analysts predicted that strong global crush and high soybean availability will satisfy global demand for soymeal, keeping prices in a sideways pattern in 2016.

“Since the 2012 US drought, global consumption has increased, on average, by just over 10 million tons per year, despite relatively high prices in most of these years. The global economic slowdown is not expected to significantly lessen the demand for animal products and will, therefore, have a limited impact on soymeal use for feed,” said the Rabobank team in the Dutch bank’s agri-commodity outlook for the coming 12 months.

However, the researchers noted two wild cards in the soymeal market in Argentina and India.

“With a change of government in Argentina, the market is watching to see if the country cuts export taxes and becomes a more aggressive exporter of soybeans instead of soymeal. While India continues to consume more soymeal domestically and export less, the world market is having to make up the shortfall,” said the analysts.

They predicted that, as in other components of the soybean complex, there is likely to be a relatively flat soymeal futures market for 2016: “Soymeal prices have been supported relative to soy oil, as evidenced by strong crush margins and the meal share of crush. While we acknowledge demand is projected to remain strong, for the first time since the 2006-07 crop year, all of the major soybean-producing countries have plenty of supplies to crush and, therefore, soymeal supply to meet demand. Because of adequate available supplies, buyers will be less inclined to buy ahead.”

Dip forecast in global wheat stock levels

Wheat prices will remain under pressure, following large global stocks, coupled with low year-over-year demand growth, according to the agri-commodity outlook.

The Dutch team said that global wheat stocks-to-use ratio is a comfortable 31%, which will keep prices range-bound.

However, despite record wheat production in 2015-16, the analysts said the quick growth of stocks over the last few years will likely slow down this season as the current relatively low price level is expected to support decent global demand growth.

“A good-sized Black Sea wheat crop has set the price benchmark for global FOB prices over the last few months, but exports from the region are slowing down with the arrival of winter, and other regions — such as the EU — will fill the gap.

We project wheat prices to remain almost neutral and mainly above the USD $5/bushel level. However, production risks still persist and will likely resurface over the growing season, which could support prices in 1H 2016.”

Ample global corn supply could tighten

Corn prices, believed to have already found their lows, are expected to strengthen into 2016, predicted the Rabobank researchers.

A fourth consecutive year of stock building put the global corn market in a very well-supplied position by the beginning of the 2015-16 marketing year, said Rabobank.

In just two years, stocks have grown 42% and pushed prices down to levels below USD $4/bushel, the analysts noted.

“However, the ample global supply is forecast to dry out somewhat in the 2016-17 season. US corn yields in 2015-16 were close to last year’s record, but combined with lower acreage, resulted in a 3% decline in production from last year’s all-time high. Most corn areas in Europe faced low production due to heat stress during the 2015-16 harvest.

After a very good crop in 2015, the outlook for the previously ever-growing South American corn crop is twofold - Brazil’s summer corn crop and Argentina’s output are shrinking, while hopes for a further substantial increase of Brazil’s safrinha crop still persist,” said the agribusiness specialists.

China is a big corn-producing region and showed continued strong production growth in 2015-16, which in itself creates difficulties.” High-priced domestic corn is not quickly absorbed by China’s feeding and processing sectors, which results in large quantities being moved into government reserves, pushing domestic stocks higher than ever,” wrote the analysts. However, there has been speculation this week that the Chinese government may act in this regard.