Soy cultivation: What is the path to sustainable land use in Brazil?

“The speed of clearance of forest in the region is very concerning. We can’t afford for it to continue,” said Nathalie Walker, senior manager, tropical forest and agriculture project, at National Wildlife Federation.

“Soy traders need to be facilitated in this. It is a complex issue. The message we are trying to promote is that there does not have to be a trade-off between production and protection. There are 25 million hectares of already cleared land in the Brazilian Cerrado for example that is suitable for soy,” she told us.

Walker participates in a project that is funded by the same group - the Norwegian Agency for Development Cooperation (Norad) - that grant aided the Mighty Earth investigation into soy-linked deforestation in Brazil and Bolivia and its claims Cargill and Bunge are facilitating that.

The project she is involved in is aimed at breaking the link between agriculture commodities – soy, palm oil and cattle – and tropical deforestation in Brazil, Indonesia, Colombia and Peru.

Mapping available land

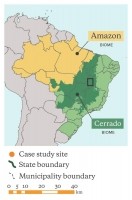

Unabated soy expansion in the Cerrado would have detrimental effect on the region, which is one of extreme biodiversity along with being Brazil’s ‘water tank’, but it is important to stress that sustainable soy production solutions exist, she said.

“Expansion needs to be managed, it needs to be planned right,” said Walker.

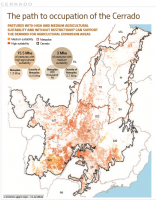

She noted the recently published report by Brazilian agribusiness analysts, Agroicone, identified available land for further soy cultivation that does not threaten critical areas of natural vegetation in the Matopiba region, the area of the Cerrado with the most deforestation for soy, according to the Mighty Earth investigation.

Agroicone’s publication concluded that pastures are the agricultural opportunity of the Cerrado, the path to optimizing land use:

“There are at least 25.4 million hectares – territory equivalent to the size of the state of Parana – of already converted lands that are suitable for agriculture. Most of this territory, which is already occupied by anthropic uses and highly suitable and unrestricted for soybeans, is outside of Matopiba, totaling 22.5 million hectares to be used for crops. In Matopiba, only 2.8 million hectares have the same conditions.

"It is worth highlighting that pastures (15.5 million hectares) occupy most of these highly suitable areas. This fact, associated to the cattle ranching intensification trend, where increased productivity in a specific area frees less productive areas, poses a strategic opportunity for agribusiness that can expand soybean production in previously occupied pasture areas, without the necessity of further deforestation.”

Walker wants to create greater awareness about this mapping of sustainable production zones with the agribusiness giants. “The soy traders encourage expansion wherever they put their silos. They have the ability to control the logistics of soy production.”

Soy moratorium extension

She sees smaller soy farmer certification under the Roundtable on Responsible Soy (RTRS) or ProTerra schemes as having impact but that wider compliance with such programs will not happen overnight due to the effort required on the part of the producer to meet the criteria.

In addition, few consumer facing companies, retailers or soy traders are prepared to pay the premiums involved under the RTRS and ProTerra schemes, she said.

In the short term, the extension of the soy moratorium from the Brazilian Amazon to the Cerrado would have more immediate effect in limiting deforestation, she argued.

“The moratorium is highly effective as farmers who don’t comply with the rules are automatically opted out. The mapping consultancy responsible for monitoring the moratorium in the Brazilian Amazon has mentioned it could implement a monitoring system for the Cerrado; it would not cost much to extend it to that region.

“So much attention has been given over to whether the moratorium would be extended in the Amazon and, in the meantime, other areas have been overlooked,” she said.

The moratorium is a private sector voluntary agreement, which, since 2006, has prohibited participants from trading, acquiring or financing soybeans from areas of the Amazon Biome that were deforested after July 2008.

Prior to the moratorium, soy accounted for roughly a fifth of recent deforestation there, while today its share is less than 1% even though soy cultivation increased by some 250% in the period, found a study written by Walker, Holly Gibbs et al.

Media spotlight

Walker praised the Mighty Earth report for helping to shine the media spotlight on the Brazilian Cerrado and the Bolivian Amazon.

While agribusiness has made very public commitments to stopping soy-linked deforestation in the Brazilian Amazon, there has been very little media coverage of the destruction of habitats in other regions of Latin America – it often takes media exposure and NGO pressure for companies to act, she said.

“Companies cited reputational risk when asked in a survey by CDP about the factors that motivate them to take action on deforestation,” she noted.

It is rare to see unilateral action by companies in terms of sustainability moves, said Walker. “Usually there is some level of advocacy effort behind any such action by a corporation.”

The role of NGOs is not just about advocating for action, she added. "They also provide a lot of expertise and data to help companies develop and implement systems for avoiding deforestation."

Glenn Hurowitz, one of the authors of the Mighty Earth report, said in the wake of that investigation and the media response, soy traders, Bunge and Cargill, are facing escalating pressure for supply chain reform from their customers, investors, and the public.

Those two companies, along with ADM and Louis Dreyfus, met with a coalition of NGOs last week (Tuesday 14 March) at the Soft Commodities Forum to decide next steps, he said.

Investor action

Kate Kroll, shareholder advocate at investor action group, Green Century, said it organized 38 investors in the US and globally, representing more than a half trillion dollars ($617.5 billion) in assets under management (AUM), to demand that companies reaffirm and extend zero deforestation commitments specific to Latin America.

The move came on the heels of the Mighty Earth report, she said.

On behalf of the investors, Green Century sent a letter to companies demanding traders as well as public-facing companies including McDonald’s and Wal-Mart drop suppliers using unsustainable clear-cutting techniques that cause deforestation.

Kroll said the letter was “intentionally ambiguous”. The idea is for companies to come up with an industry-wide joint action mechanism themselves, a deforestation program that can potentially protect investors globally, she added.

The letter noted individual company-by-company approaches have proven insufficient in reducing deforestation linked to agricultural commodities compared to joint action mechanisms like the Brazilian soy moratorium, which has helped cut deforestation linked to soy production in the Amazon from 30% to 1%. “Failure to keep pace with shifting market expectations for sustainable production spanning wider geographic regions may pose the significant risks many companies with existing policies have hoped to avoid, including restricted market access, reputational damage, loss of goodwill, and barriers to capital.”

Kroll said the most promising response so far has come from ADM. “It recognizes that industry wide action on deforestation-free commodity production means companies can share the burden,” she said.

Green Century can leverage its clout as a shareholder to press top US companies to make their supply chains more sustainable. However, as Cargill is a privately owned agribusiness, it cannot influence change in that company in the same way.

“We are hopeful of a meaningful step forward by Cargill on this. Its intentions are in the right place but they have to be translated into action,” added Kroll.